- Understand your insurance policy fully and keep all related documents organized for hassle-free claim processing.

- Be honest during claim filing; exaggerations may lead to claim denials or legal complications.

- Consider hiring a specialist lawyer if you’re treated unfairly, or your claim is denied.

- Patience and persistence are key when dealing with time-consuming insurance claims processes.

Dealing with insurance companies can be a stressful and frustrating experience. Whether you’re filing a claim for car accidents, property damage, or medical bills, it’s essential to know your rights as a policyholder and protect yourself from unfair practices. This blog will discuss legal tips on how to deal with insurance companies so you can get the compensation you deserve.

Read your policy carefully.

Before dealing with insurance companies, it’s essential to read your policy carefully and understand what it covers. Many people make the mistake of assuming that their policy covers everything, only to have their claim denied later on. Therefore, read the fine print of your policy and ask questions to your insurance provider. Knowing what you’re entitled to will help you get an idea of what you can claim and the amount you could receive.

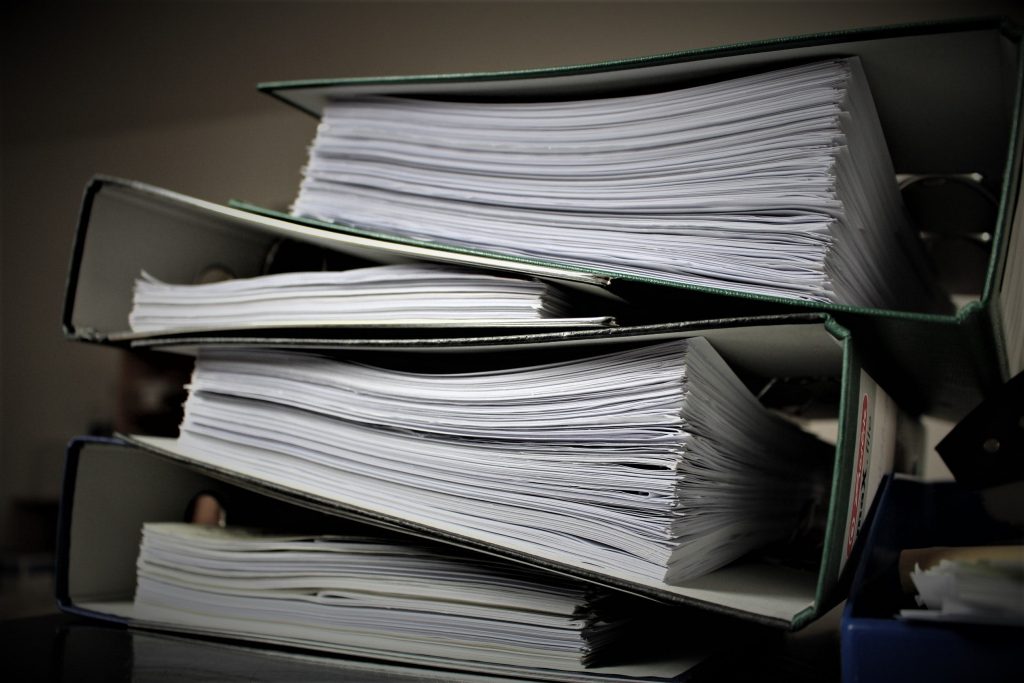

Know how to handle your documents.

When dealing with insurance companies, it’s crucial to keep all documents related to your policy and claims organized. This includes correspondence, receipts, medical records, and any other relevant paperwork. Here are four essential tips for handling your documents:

Keep copies of everything.

Always make copies of any document you send to the insurance company or receive from them. This will help you keep track of what was sent and received, as well as serve as evidence in case of a dispute. You can also keep digital copies of your documents for easy access and backup.

Use a filing system.

It’s best to have a dedicated folder or binder solely for your insurance documents. A good filing system will make it easier to find specific information when needed rather than sifting through piles of papers.

Take detailed notes.

Whenever you communicate with the insurance company, whether it’s over the phone or in person, make sure to take detailed notes. Write down the date and time of the conversation, who you spoke to, and what was discussed. These notes can come in handy if there are any discrepancies later on.

Keep a log of expenses.

If you’re filing a claim for property damage or medical bills, keep a log of all related expenses, including receipts. This will help you keep track of the costs and provide proof to the insurance company. You could also use a spreadsheet or budgeting app to track your expenses.

By handling your important documents efficiently, you can make the claims process smoother and less stressful.

Be honest, and don’t exaggerate.

Insurance companies have ways to verify your claim, so be honest and don’t exaggerate your loss or injury. Even minor exaggerations might be discovered, and this will ruin a person’s chances of maximizing their claim. Stick to the facts so that there will be little room for any challenges to your claim. Exaggeration of the claims might lead to your claim being denied as well.

Work with a lawyer.

If you feel that you’re not being treated fairly or that your claim is being denied, consider hiring a lawyer. But don’t just hire any lawyer. Get a lawyer who specializes in handling the kind of case you have. For example, you’ll need a trusted car accident lawyer if you’re filing a claim for a car accident. A lawyer will help guide you through the legal process and protect your rights. They can even negotiate with the insurance provider on your behalf and help you get the best possible outcome.

Be patient.

Dealing with insurance companies is a time-consuming process, so be patient. Claims can take weeks or even months, especially for more complex claims. Keep on following up with your insurance firm, but remember that they might be dealing with thousands of other cases, too. Keep track of the documentation and stay organized. Remember that getting the compensation you deserve is worth the wait, especially if you’ve documented everything properly.

Dealing with insurance companies can be a daunting task, but it doesn’t have to be. Armed with a good understanding of your policy, organized documentation, honesty, legal advice, and patience, you can navigate this process successfully. Remember, knowing your rights and responsibilities as a policyholder is crucial in securing the compensation you deserve.

Don’t hesitate to seek legal help if things get complicated because everyone deserves fair treatment when it comes to insurance claims. Keep these tips in mind, stay resilient, and you’ll be well-equipped to handle any insurance-related issues.